Lets imagine waking up one morning, checking your bank app, and realizing that those nagging high-interest loans are finally paid off. No more sleepless nights worrying about compounding interest eating away at your paycheck. Sounds like a dream, right? But in October 2025, with U.S. household debt hitting a record $18.39 trillion in Q2—up from $18.20 trillion earlier this year—and credit card balances alone surging to $1.21 trillion, this dream feels out of reach for many. The average American household now owes around $105,000, with credit card delinquency rates at 8.58% and interest rates averaging 22.83% for cards accruing interest. If you're drowning in high-interest loans like credit cards or payday advances, you're not alone—46% of cardholders carry balances month-to-month. But here's the empowering news: You can master debt repayment without a windfall or drastic life changes. This comprehensive framework, drawn from expert strategies and real-world successes, will guide you step by step. We'll cover assessment, proven methods, budgeting hacks, and more—all tailored for 2025's economic realities. By the end, you'll have actionable tools to reclaim your financial freedom. What's your biggest loan struggle? Share in the comments—let's build a community of support!

Step 1: Assess Your Debt Landscape—Know Thy Enemy

The first pillar of any solid repayment framework is a thorough assessment. Without knowing the full picture, you're fighting blind. Start by listing all high-interest loans: Credit cards (often 20-25% APR), personal loans (10-36%), or payday loans (up to 400% effective APR). Note balances, rates, minimum payments, and due dates.

Use free tools like Excel or apps such as Debt Payoff Planner to organize. Calculate your debt-to-income ratio: Divide total monthly debt payments by gross income. If it's over 36%, prioritize aggressively—lenders see this as risky, and so should you.

Why this matters in 2025? Delinquency rates for credit cards are elevated at 4.4% overall, with 90-day delinquencies climbing in certain areas. Track expenses for a month to spot leaks—average Americans waste $200/year on unused subscriptions alone. One tip: Pull your free credit report from AnnualCreditReport.com to uncover hidden debts.

Engagement moment: Have you audited your loans lately? Try it this week—what surprises you? Sharing could reveal common pitfalls we all face.

This step sets the foundation: A clear view reduces overwhelm and empowers decisions. Remember, knowledge is the antidote to debt anxiety.

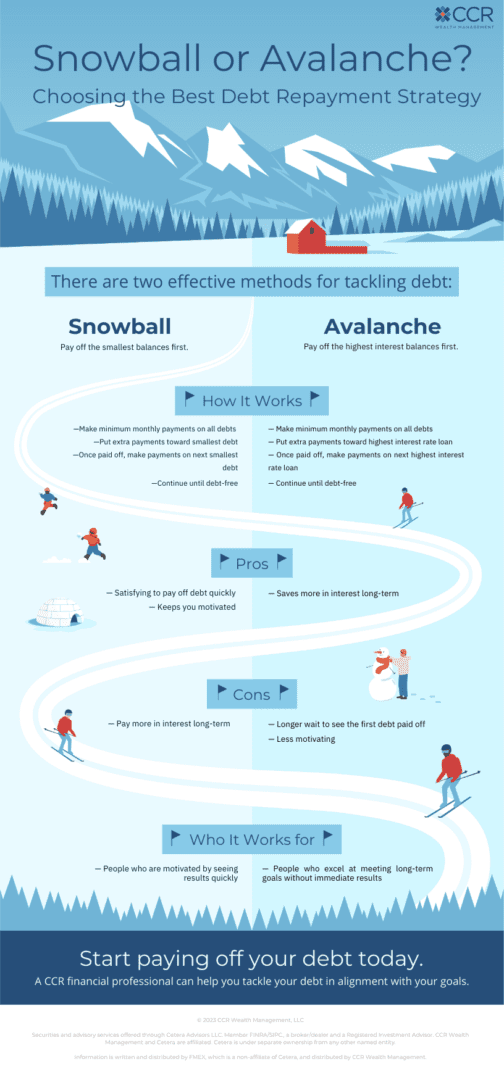

Step 2: Choose Your Repayment Strategy—Avalanche, Snowball, or Hybrid?

With your debt mapped, pick a battle plan. Two classics dominate: The Debt Avalanche (math-optimized) and Snowball (psychology-driven). In 2025's high-rate environment, where average card APRs hit 22.83%, strategy choice can save thousands.

Debt Avalanche: Target highest-interest loans first while paying minimums on others. Pros: Minimizes total interest—save 10-20% more than snowball. Cons: Slower motivation if high-rate debt is large.

Example: $10K at 25%, $5K at 18%, $3K at 15%. Extra $300/month on the 25% could clear it in 18 months, saving $1,200 in interest.

Debt Snowball: Pay off smallest balances first. Pros: Quick wins boost adherence—studies show higher completion rates. Cons: Higher total interest.

Example: Clear $3K first in months, roll payments—builds momentum like a snowball.

Hybrid Approach: Start snowball for early victories, switch to avalanche. Ideal for balanced motivation and efficiency.

| Strategy | Focus | Best For | Potential Savings |

|---|---|---|---|

| Avalanche | Highest Interest | Analytical Types | Max Interest Reduction |

| Snowball | Smallest Balance | Motivation Seekers | Psychological Wins |

| Hybrid | Combo | Most People | Balanced Approach |

Choose based on personality—NerdWallet recommends avalanche for high rates like today's. Track with apps; celebrate milestones to stay engaged. Which strategy calls to you? Test one and comment your results!

Step 3: Build a Bulletproof Budget—Redirect Funds to Debt

No framework succeeds without budgeting. Use zero-based: Assign every dollar a purpose, prioritizing debt. In 2025, with living costs up, this reallocates without extra income.

Adopt 50/30/20: 50% needs, 30% wants, 20% savings/debt—but amp debt to 25-30% by trimming wants.

- Track Ruthlessly: Apps like YNAB categorize automatically.

- Cut Smart: Negotiate bills (50-80% success), meal prep ($100-200/month saved), cancel subs.

- Automate Payments: Avoid late fees, which add 1-5% APR penalties.

Real example: A family redirected $400/month from dining out, paying $15K in two years. Pro tip: No-spend challenges on weekends free $50-100 weekly.

Your budget is your weapon—review monthly. What's one cut you can make? Let's brainstorm in comments.

Step 4: Explore Advanced Tactics—Consolidation, Transfers, and Negotiation

Level up with these tools for high-interest loans.

- Balance Transfers: Move to 0% APR cards (12-21 months). Fees 3-5%, but saves big—$1,000 on $10K at 24%.

- Debt Consolidation: Roll into lower-rate loan (7-15% vs. 24%). Simplifies payments; credit unions offer best deals.

- Negotiation: Call lenders—many drop rates 1-5% for good payers. Or use counseling from non-profits like NFCC.

Caution: Avoid new debt. In 2025, with delinquencies rising, these tactics are timely. Story: One borrower consolidated $20K, cutting interest in half and paying off in 3 years.

Eligible? Check your score—670+ unlocks best options. Tried negotiation? Share tips below!

Step 5: Leverage Resources and Avoid Pitfalls—Sustain Your Progress

Tools: Apps (Debt Snowball Calculator), books ("Total Money Makeover"), communities (Reddit's r/debtfree).

Common mistakes: Ignoring emergencies (build $1K fund first), emotional spending, skipping reviews.

Sustain: Weekly check-ins, accountability partners. 2025 trend: AI budgeting apps like Cleo for reminders.

Success metric: Net worth growth—track quarterly.

Real-Life Success Stories: Inspiration from the Trenches

Meet Alex: $30K card debt at 24%. Used avalanche, budgeted fiercely—debt-free in 28 months, now invests savings.

Or Maria: Consolidated $15K loans, negotiated rates—paid off in 2 years, bought a home.

These aren't outliers—45% report life improvements post-payoff. Your story next? Start today.

Final Thoughts: Your Path to Mastery Awaits

Mastering high-interest loan repayment in 2025 demands a framework: Assess, strategize, budget, advance, sustain. With debt at $18.39T and rates high, action is urgent—but possible. Commit to one step now: Audit your loans. You'll gain freedom, reduce stress. What's your first move? Comment below—let's celebrate wins together!

0 Comments